The Defence Force Welfare Association (DFWA) welcomes the appointment of Major General Natasha Fox AM, CSC to the newly created and critically important position of Chief of Personnel within the Australian Defence Force.

In August 2022 the Royal Commission into Defence and Veteran Suicide released its Interim Report recommending the consolidation of veterans’ legislation. On 16 February 2023, the Minister for Veterans’ Affairs announced the commencement of consultation on the legislation pathway that has been developed by Government.

On 16 December 2022, the Government announced reform to Australia’s system of administrative review. This reform will abolish the Administrative Appeals Tribunal (AAT) and establish a new federal administrative review body.

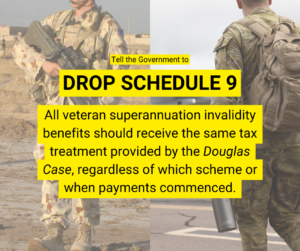

Veterans who are medically discharged from the Australian Defence Force may receive Invalidity Benefits from their super scheme depending on extent of disability. However, Veteran Invalidity Benefits are not all taxed the same way.

Veteran Superannuation Invalidity Benefits are not paid for life, and Government can review or cancel them at any time up to the age of 55. They should not be taxed as if they are a permanent benefit. Tell the Government to drop Schedule 9 of the Treasury Laws Amendment (2022 No 4) Bill

Camaraderie Vol 54, No 1 available to view or download online.

On 3 March 2023, the Senate Economics Committee released its report on the Treasury Laws Amendment (2022 Measures No 4) Bill 2022 which included legislative amendments affecting Military Superannuation Schemes Invalidity Benefit Taxation.

Today The Hon Matt Keogh MP, the Minister for Veterans’ Affairs and Defence Personnel announced the commencement of public consultation on a Pathway to simplify…

The Treasury Laws Amendment (2022 Measures No. 4) Bill 2022 includes proposed changes to how some veteran superannuation invalidity benefits are taxed, following the Douglas decision. DFWA made a submission to the Senate Economics Legislation Committee regarding the proposed amendments.

Camaraderie Vol 53, No 3 available to view or download online.